Difference between revisions of "Superannuation"

From TrueERP wiki

(Created page with "<menu name=myMenu2 align=center> Employee Screens = Address Allowances Banking Commission Custom Fields Deductions Documents Fringe Benefits [[Hou...") |

|||

| (2 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

<menu name=myMenu2 align=center> | <menu name=myMenu2 align=center> | ||

| − | + | More Detail = | |

[[Address]] | [[Address]] | ||

[[Allowances]] | [[Allowances]] | ||

| Line 19: | Line 19: | ||

[[Taxation]] | [[Taxation]] | ||

[[Workcover]] | [[Workcover]] | ||

| − | |||

</menu> | </menu> | ||

| − | == Overview == | + | == Overview == |

| + | |||

| + | ERP allows for the broad range of superannuation payment types from Superannuation Guaranteed Contributions to Salary Sacrifice and optional contributions. The types available are as follows: | ||

| + | |||

| + | *Super Guarantee | ||

| + | *Employer Optional | ||

| + | *Employer Negative | ||

| + | *Salary Sacrifice | ||

| + | *Employee Optional | ||

| + | *Employee Negative | ||

| + | *Spouse Contribution | ||

| + | |||

| + | Super Guarantee, Salary Sacrifice and other Employer contributions post to Payroll Liabilities - Superannuation ready for future payment. Employee contributions post to Payroll Bank to facilitate immediate payment to the Super Fund by cheque or EFT (see [[Supplier Payments]] | ||

| + | |||

| + | '''How to use Salary Sacrifice''' | ||

| + | |||

| + | Salary Sacrifice is by definition an arrangement where the employee agrees to accept a reduced salary<br>in return for increased employer superannuation contributions. The amount entered as a salary sacrifice type<br>contribution will reduce the employees gross salary by the same amount. <br>Refer ATO Website<http://www.ato.gov.au/businesses/content.asp?doc=/content/38336.htm&page=6&H6> <br>NB. Because the salary has been reduced, the SGC amount also reduces. If the agreement is to compensate for <br>the lost 9% as well this must be entered as a seperate Employer Optional amount. | ||

| + | |||

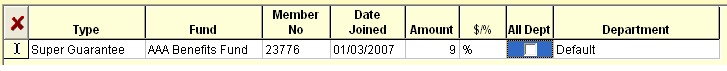

| + | Example<br>If an employee has a $2000 per week salary, the SGC is 9% or $180. The superannuation entry would<br>be as follows: | ||

| + | |||

| + | [[Image:Super1.jpg]]<br> | ||

| + | |||

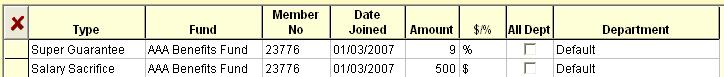

| + | If the employee decides to Salary Sacrifice $500 per week the entry would look like this: | ||

| + | |||

| + | <br> | ||

| + | |||

| + | [[Image:Super2.jpg]]<br> | ||

| + | |||

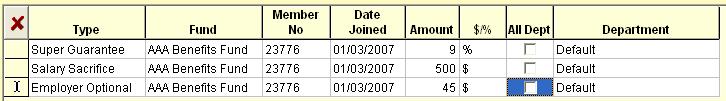

| + | Note that the 9% guarantee is calculated on the new salary of $1,500 and will now be $135. If the employer <br>agrees to compensate the lost $45 (9% of $500) the additional amount is not deemed to be SGC as Salary Sacrifice amounts <br>are not ordinary time earnings. It also cannot be entered as Salary Sacrifice because this will further reduce the salary. This <br>contribution is Employer Optional and looks like this: | ||

| + | |||

| + | [[Image:Super3.jpg]] | ||

| + | |||

| + | <br> | ||

| + | |||

| + | <br> | ||

| + | |||

| + | <br> | ||

Latest revision as of 16:30, 3 March 2011

Overview

ERP allows for the broad range of superannuation payment types from Superannuation Guaranteed Contributions to Salary Sacrifice and optional contributions. The types available are as follows:

- Super Guarantee

- Employer Optional

- Employer Negative

- Salary Sacrifice

- Employee Optional

- Employee Negative

- Spouse Contribution

Super Guarantee, Salary Sacrifice and other Employer contributions post to Payroll Liabilities - Superannuation ready for future payment. Employee contributions post to Payroll Bank to facilitate immediate payment to the Super Fund by cheque or EFT (see Supplier Payments

How to use Salary Sacrifice

Salary Sacrifice is by definition an arrangement where the employee agrees to accept a reduced salary

in return for increased employer superannuation contributions. The amount entered as a salary sacrifice type

contribution will reduce the employees gross salary by the same amount.

Refer ATO Website<http://www.ato.gov.au/businesses/content.asp?doc=/content/38336.htm&page=6&H6>

NB. Because the salary has been reduced, the SGC amount also reduces. If the agreement is to compensate for

the lost 9% as well this must be entered as a seperate Employer Optional amount.

Example

If an employee has a $2000 per week salary, the SGC is 9% or $180. The superannuation entry would

be as follows:

If the employee decides to Salary Sacrifice $500 per week the entry would look like this:

Note that the 9% guarantee is calculated on the new salary of $1,500 and will now be $135. If the employer

agrees to compensate the lost $45 (9% of $500) the additional amount is not deemed to be SGC as Salary Sacrifice amounts

are not ordinary time earnings. It also cannot be entered as Salary Sacrifice because this will further reduce the salary. This

contribution is Employer Optional and looks like this: