GST on Imports

From TrueERP wiki

Overview

Typically GST on imports is payable on an assessed amount rather than the actual amount paid for the import. Furthermore this assessed amount may not be advised to you until some time after the original Purchase Order has been paid and closed. Following is a process that allows you to pay the GST amount through a Bill and have it appear on your BAS report.

Following this process only the Assessed Value of the import is the value reported under Other Acquisitions in your BAS return for the period in which the GST is paid. Please consult your accountant to ensure this is his preferred approach.

How to Pay GST on Imports

Step one is the creation of the initial Purchase Order Process the initial Purchase Order with a tax code of NT. This means the amount will not be reported in your BAS return.

Next is the creation of a Bill to pay GST and any other landed costs. In this example we will presume there are no other landed costs. *Select Purchases

- Select Bill

- Enter the Supplier Name

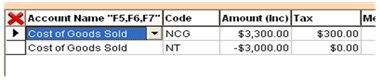

- Select a clearing account. eg. you could use a Cost Of Goods Sold account for this purpose.

- Enter the assessed value of the import on which the 10% GST has been calculated. Use Tax Code NCG or CAG as applicable In the next applicable.

- In theline select the same clearing account and enter the assessed amount (ex) as a negative amount with a tax code of NT eg.